AstraZeneca plc, a British-Swedish multinational pharmaceutical and biotechnology firm has begun to move away from providing its coronavirus vaccine to nations on a not-for-profit basis as the world learns to live with the lethal virus. Instead, the pharmaceutical giant has signed a series of for-profit deals for 2022 and anticipates making a modest profit from the jab.

In its fresh financial outcomes, a Cambridge, UK-based drug firm said that the firm is now anticipating to progressively transition [to making a profit on the vaccine] to modest profitability as further orders are received.

The drug company has earlier said that it would only begin to make a modest income from the jab when COVID was no longer a pandemic. However, Pascal Soriot, Chief Executive Officer of AstraZeneca, said the fatal “disease was becoming endemic.”

AstraZeneca committed to selling the COVID-19 dose manufactured with Oxford University at cost during the epidemic and, in a news briefing on Friday, said that emerging nations would continue to get the jab on a no-profit basis, while a post-pandemic commercial tactic would apply to further new orders even as cases in Europe increase again.

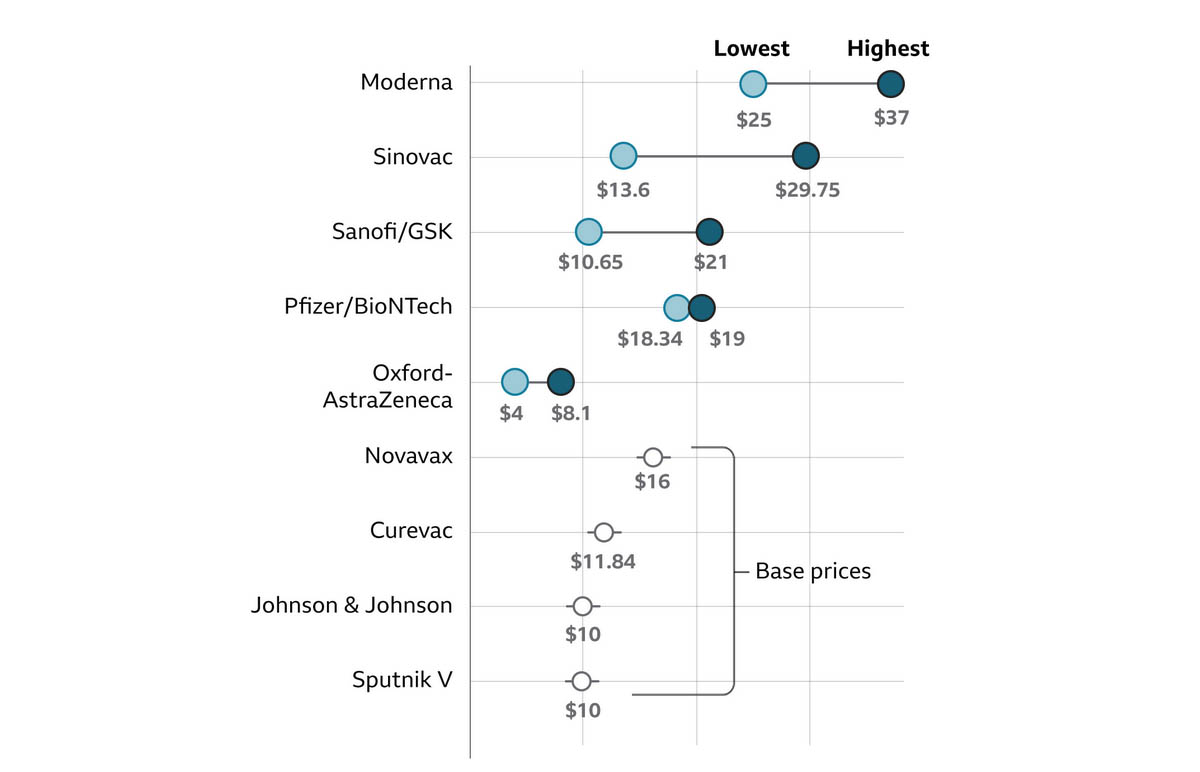

COVID-19 Jab Producers Are Charging Different Prices

The Company’s 3rd-quarter outcomes showed the jab contributed one-cent to core earnings per share of 1.08 dollars, an increase of 14 percent. Total product sales around 49 percent to 9.74 Bn dollars, as its jab sales topped one billion dollars.

Soriot said that they began this project to help, but at some stage in the future, they’d transition to commercial orders. He added vaccines would never be pricey because they want the jab to remain affordable to everyone worldwide.

All prices are subject to trade deals

Source: WHO, UNICEF, US Government Contracts

By the end of 2021, AstraZeneca anticipates having supplied 250M vaccine doses of its jab to the COVAX program for emerging nations.

Other COVID-19 vaccine manufacturers, including Moderna and Pfizer, have been making income from their jabs. An average profit margin in the pharmaceutical industry is 20 percent, but AstraZeneca CEO said that its company, which charges nearly 5 dollars per dose for coronavirus jab at cost price, wouldn’t be earning as much profit like that.

Furthermore, shares of the drug company were down 3.4 percent at approximately 91.22 pounds at 1209 GMT as overall 3rd-quarter profit fell short expectations of analysts.

Source: Web

In November, Pfizer forecasted 2021 and 2022 sales from its coronavirus jab of at least 65 Bn dollars overall, topping estimates. However, Moderna Inc. reduced its current year sales outlook for its dose by as much as 5 Bn dollars on production hiccups.