Because of the March’s historic downfall in the oil prices internationally, different analysts on Wall Street expressed their fear that the crude oil prices may fall below $40 per barrel. It will cause huge tension for the jobs of hundreds of thousands of employees working in the industry.

The chief economist in PGIM Fixed Income, Nathan Sheets, said in a mail that consistent fall in oil prices causes unemployment of 50,000 to 75,000 jobs in case if employment back to its low, few years ago.

During previous oil prices fall in 2015-2016, the United States’ employment in the oil industry dropped down by one-third. Sheets continued that in recent years, most of the employees have been returned, but in the current sustained position of low oil prices would definitely cause unemployment like previous troughs.

International Brent Crude and the United States WTI (West Texas Intermediate) Crude both displayed their worst day last week, since 1991.

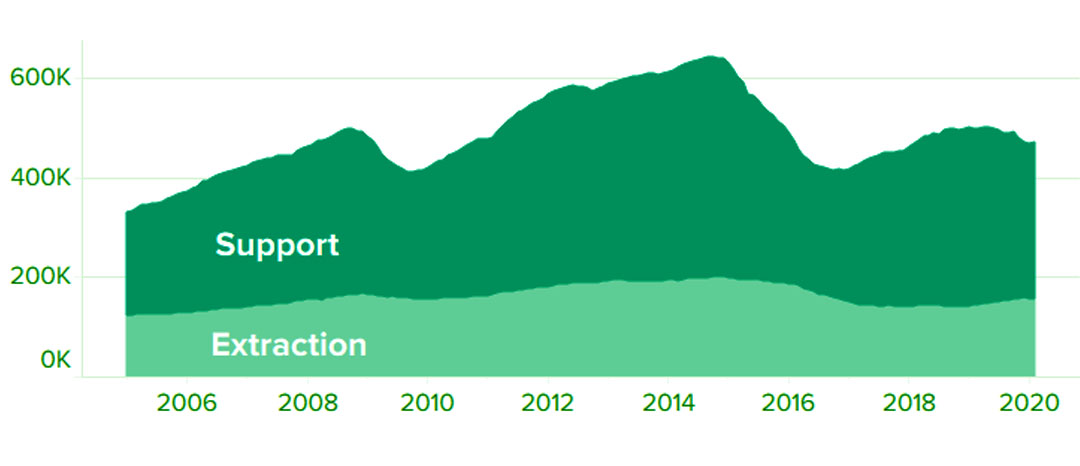

Oil and Gas Jobs

Monthly totals for extraction and Support-related roles

After the failure of OPEC’s deal with ally Russia on oil production cuts in favor of supporting crude oil prices, WTI jumped 24.59% to $31.13 barrel. Moreover, that turn the Saudis to halt their own oil prices and spread fear of price war all around the world.

Source: Bureau of Labor Statistics. Data through February 2020.

A significant drop in oil prices tend to put a complex impact on American, and it could drive to a drastic condition. Moreover, a drop in oil prices definitely led to cheaper gasoline and pushed freedom on the United States’ consumers to use their money elsewhere.

Donald Trump, the president of the U.S, tweeted that Russia and Saudi Arabia are arguing on the flow of the oil as well as prices. And he added the reason for their market decline that Fake News is the is cause of dropping the market. He continued that it’s a good thing for consumers that gasoline prices are down.

Saudi Arabia and Russia are arguing over the price and flow of oil. That, and the Fake News, is the reason for the market drop!

— Donald J. Trump (@realDonaldTrump) March 9, 2020

Good for the consumer, gasoline prices coming down!

— Donald J. Trump (@realDonaldTrump) March 9, 2020

The analyst told that other businesses such as restaurants that have no concern to oil or gas are also affected or under pressure. Furthermore, Occidental and Diamondback are two drastically bad performing stocks in 2020 that are down more than 70%. Similar case happened with Marathon stock, which is considered the fourth with the worst drop of 69%.

PGIM’s Sheets said to CNBC the shale industry is supposed a remarkable innovation engine to the United States’ economy in a few recent years. That’s why, the increase in the crude oil production has decreased the U.S. exposure to the region of the Middle East.