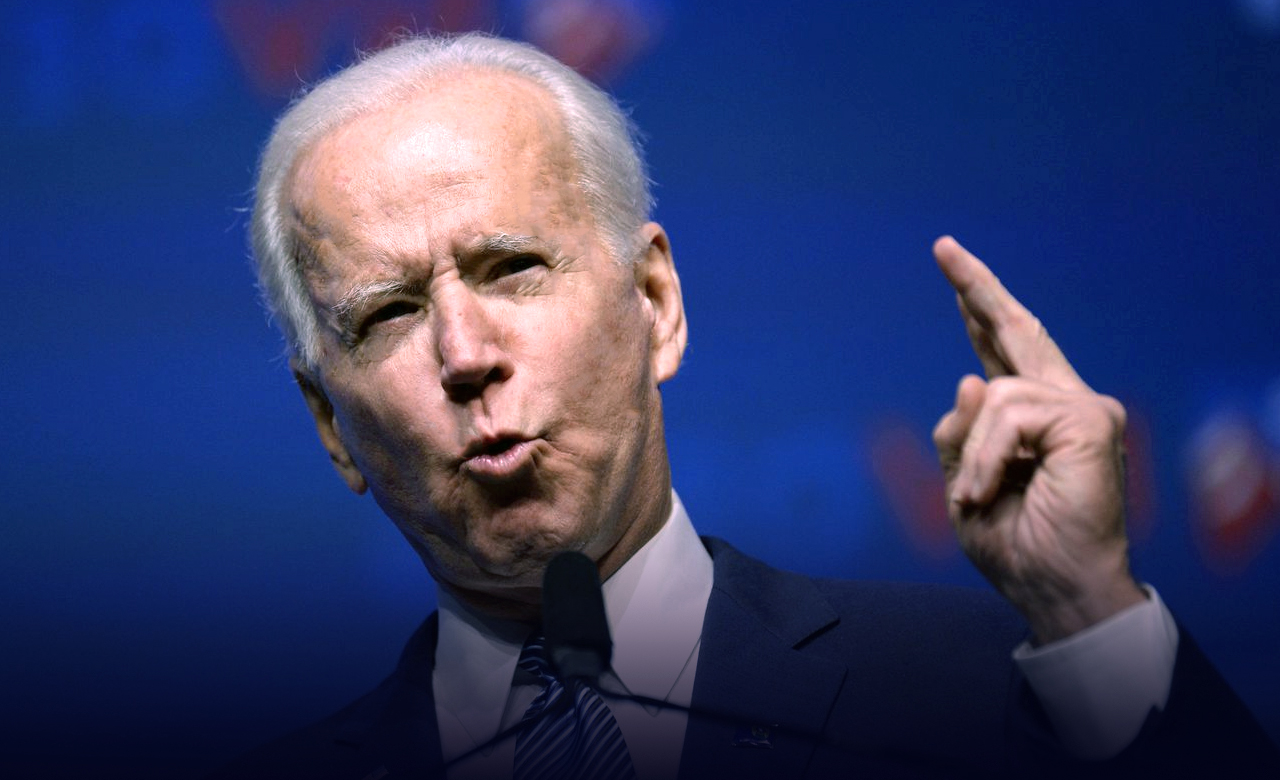

During a Bloomberg interview, Jeremy Grantham, the legendary investor, threatened other entrepreneurs that the 1.9 trillion dollars bill in the federal aid President Biden sees from Congress would further plunge the stock market bubble.

The GMO co-founder, Jeremy Grantham, described to Erik Schatzker that he has no ambiguity that federal money will end up in the stock market. He continued that the miserable fact, about the last federal COVID-19 relief bill passed in 2020, was that it did not ramp up the capital spending and also didn’t boost real production but surely flooded into the stock market.

The strategy that President Joe Biden is offering will acquire a new round of 1,400 dollars direct money, local aid and strong state, and bills for Coronavirus vaccine distribution. Moreover, Jeremy Grantham further described that if a 1.9 trillion dollar fund was approved, it could create the horrible end of the stock market bubble.

The history book will enjoy it – Grantham

He continued that if it is as big as they talk about, this will be a very effective making of a top for the market, just of the kind that the history book is going to enjoy. Grantham said that they will have some weeks of extra money and a few weeks of putting their last, desperate chips into the game, and then more spectacular bust.

Source: Web

Jeremy Grantham has long threatened that what he sees as the United States stock market’s ballooning bubble. In the start of January, in his investor outlook letter, he explained that how extreme overestimations, frenzied issuance, explosive price increases, and what he called ‘hilariously speculative investor behavior’ all showed that the stock was in extreme trouble that not even the Federal Reserve could stop from bursting.

He explained to Bloomberg that when you have reached this close to obvious super enthusiasm, the stock market bubble always, without exception, scattered in the upcoming few months, not a few years. Furthermore, he also described that the combination of fiscal stimulus and emergency Fed strategies that supported inflate the market bubble could ramp up inflation.

Grantham told Bloomberg that if you think you live in the world where output does not matter and you can just make paper, later or sooner you are going to do the impossible, that will be brought back inflation.