United States equity futures are signaling to a big open righter after the day when stocks are harshly suffering by another nasty dive.

On Wednesday, at the time when trading starts, primary futures pointing a growth of one percent.

As oil prices are jumping between losses and gains, stocks are higher due to the flat or crushed economy of the whole world amid Coronavirus epidemic.

The energy market is facing the highest damage, and the recent crisis has nervous producers because the global economy fell down with airlines, factories, and other consumers are following the orders to stay at home.

Now the United States crude is on June agreement and trading gradually lower at 11.54 USD.

The international standard Brent Crude is on the way to ramp up more than two percent at 19.81 dollars and 47 cents up.

Since the novel Coronavirus, oil demand highly affected and reached a level that was last seen in the 1990s. Crude investors do not slow down their output, which ultimately leads to storage tanks and cannot find further room to store oil.

On Wednesday, in Asian markets, Tokyo’s Nikkei down by 0.7 cents, Shanghai Composite of China advanced 0.6%, and Hang Seng of Hong Kong ramped up 0.4 percent.

Europe Stocks

Furthermore, In Europe, DAX of Germany added 0.8 percent, CAC of France up by 0.4 percent, and FTSE of London gained 1.5 percent.

Wall Street session of Tuesday, the Dow Jones Industrial Average down by 2.7% , Nasdaq down by 3.5 percent, and the benchmark S & P 500 down 3.1 percent.

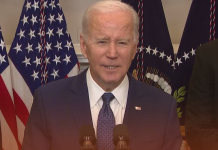

On Tuesday, the United States passed a bill of worth around 500 billion dollars for Coronavirus aid. That bill would be beneficial to help hospitals and small businesses.

At the same time, the Government of Georgia declared ideas on Monday to allow hair salons, gyms, and other small businesses to start again as early as Friday.